You can see how paper pulp prices differ across regions. The table below shows current market prices for Q4 2025:

| Region | Price | Date |

| China | 4749.58 CNY/T | Q4 2025 |

| USA | 2106 USD/MT | June 2025 |

| France | 1760 USD/MT | June 2025 |

Prices have shifted due to supply and demand changes, rising costs, and regulations. Europe and Latin America saw the highest price increases. Experts predict more changes in 2025, with weak demand and trade rules causing uncertainty. You need to watch these trends to manage risks and plan for growth.

Key Takeaways

Check global paper pulp prices often. Prices are different in each area. They can change fast when supply or demand changes.

Learn about tariffs and trade rules. These rules can change prices a lot. They also affect how easy it is to get paper pulp.

Use sustainable practices. Recycled paper pulp and biodegradable materials are good choices. More people want products that are better for the environment.

Get ready for market changes. Prices can go up or down. This happens when the economy changes or the supply chain has problems.

Try new technologies. Better recycling methods can help save money. They also make work faster over time.

Paper Pulp Prices Overview

Global Price Data

You can check global paper pulp prices using recent market reports. The U.S. Producer Price Index for wood pulp fell by 3.83% from last year. This happened because China set tariffs. These tariffs made it tough for U.S. producers to sell overseas. U.S. producers had to lower their prices. The tissue paper sector did not change much. Chemical pulp demand stayed strong since people need hygiene products. More online shopping made fiber-based packaging more popular.

In Europe, the average NBSK Price Index in Q2 2025 was 1% higher than last year. Mill shutdowns meant less new supply. But more inventory and weak buying made prices drop a little compared to last quarter.

Here is a table that shows these trends:

| Region | Price Trend Description |

| North America | U.S. wood pulp market faced downward pressure; Producer Price Index declined 3.83% YoY. |

| China's tariffs disrupted exports, pushing U.S. producers to lower prices. |

| Tissue paper sector stable; chemical pulp demand firm due to hygiene consumption. |

| E-commerce growth driving demand for fiber-based solutions. |

| Europe | Average European NBSK Price Index in Q2 2025 was 1% higher YoY; limited fresh arrivals due to mill shutdowns. |

| Price Index eased modestly quarter-over-quarter due to higher inventory levels and weaker buying interest. |

| Asia-Pacific | Trends follow global context, with demand and supply shifts affecting local prices. |

Note: The U.S. Producer Price Index for Recycled Paperboard is now at 395.07. Last year it was 400.01. This means prices dropped by -1.23% over the past year.

Regional Variations

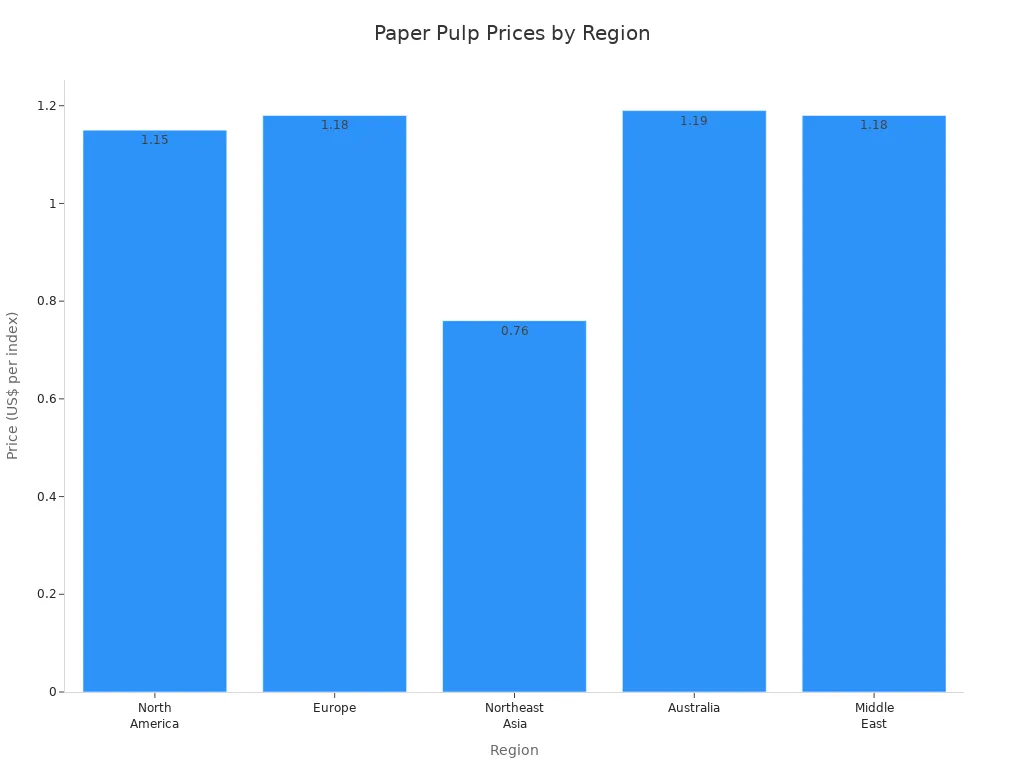

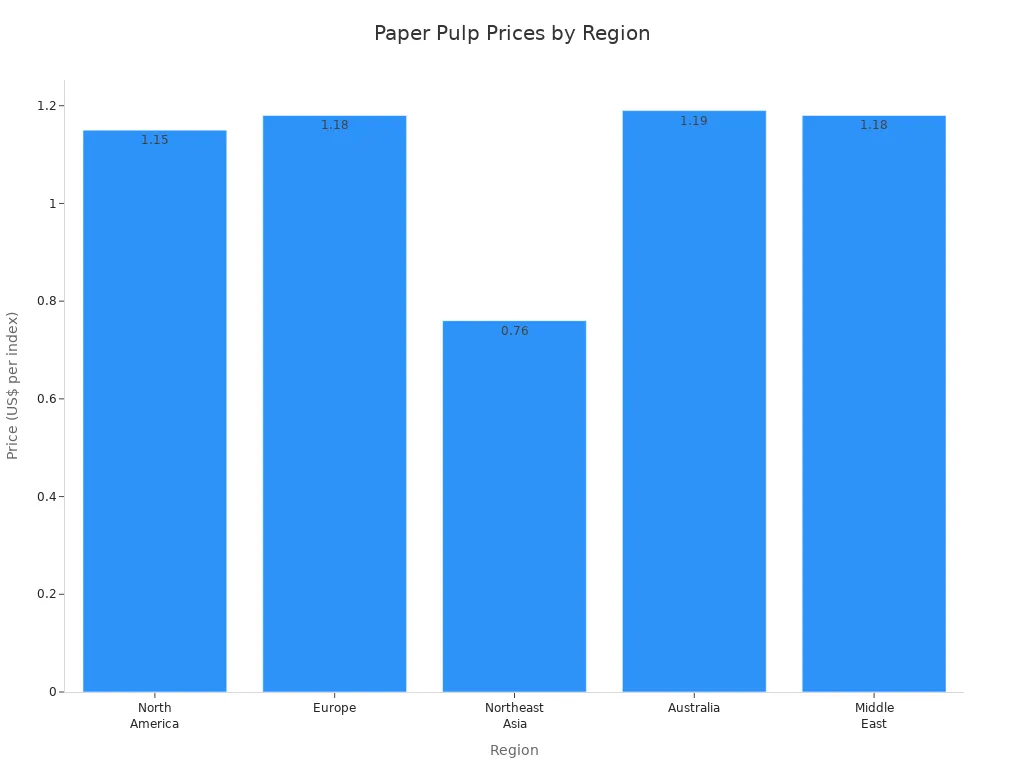

Market pulp prices are different in each region. North America, Europe, and Asia show their own patterns. The table below compares prices and changes:

| Region | Price (US$ per index) | Change (%) |

| North America | 1.15 | Unchanged |

| Europe | 1.18 | -3.3% |

| Northeast Asia | 0.76 | -1.3% |

| Australia | 1.19 | -3.3% |

| Middle East | 1.18 | -3.3% |

Europe and Australia had the biggest price drops. North America stayed about the same. Northeast Asia had a smaller decrease. These changes happen because of local supply, demand, and trade rules.

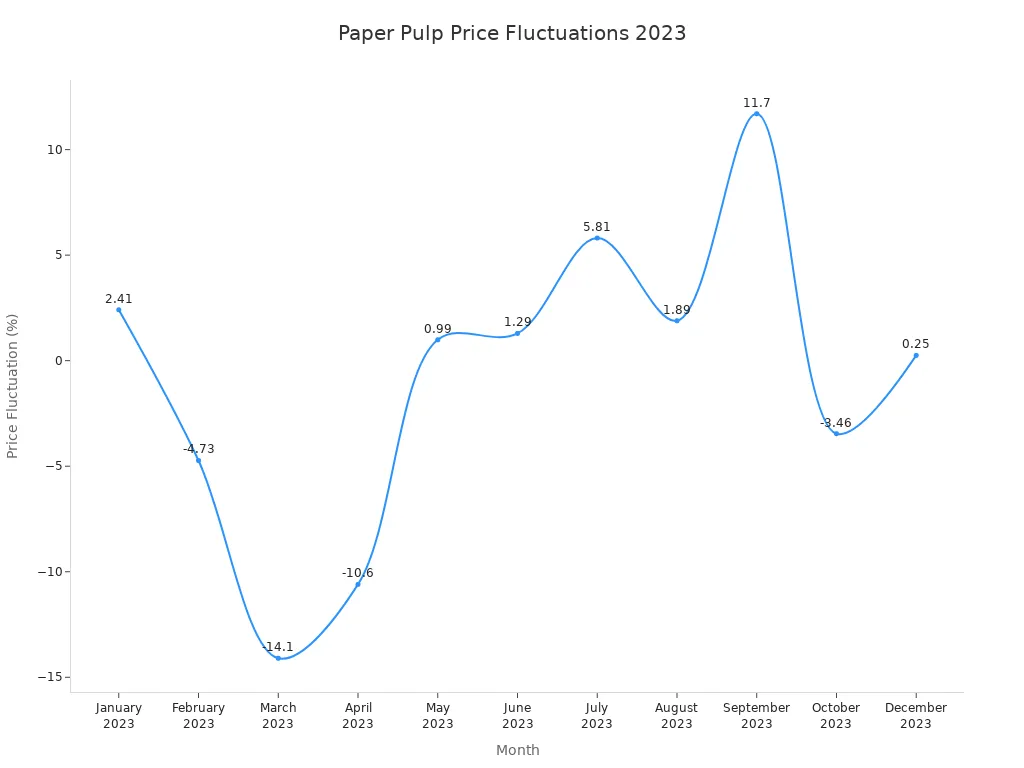

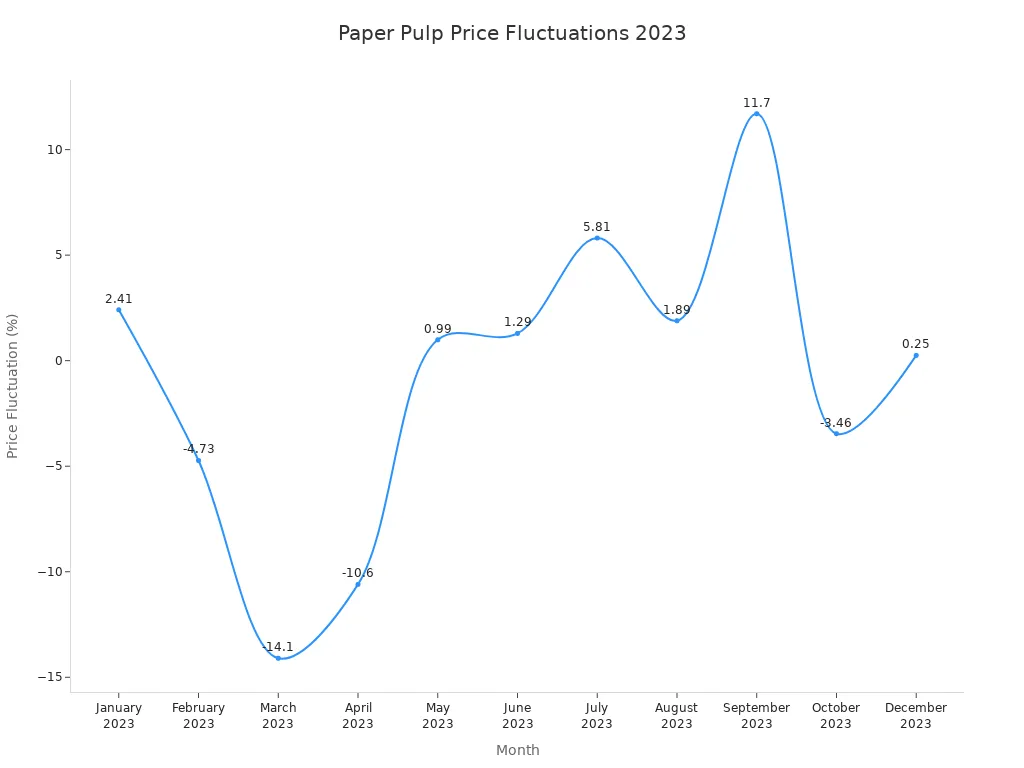

Price Fluctuations

It is important to notice how prices changed this year. The market had big ups and downs. Some months had sharp drops. Other months had gains. The table below shows monthly price changes for 2023:

| Month/Year | 2023 |

| January | 2.41 |

| February | -4.73 |

| March | -14.10 |

| April | -10.60 |

| May | 0.99 |

| June | 1.29 |

| July | 5.81 |

| August | 1.89 |

| September | 11.70 |

| October | -3.46 |

| November | N/A |

| December | 0.25 |

March had the biggest drop at -14.10%. September had the highest gain at 11.70%. These changes show the market reacts quickly to supply, demand, and outside events.

Weekly indices and the recovered paper pulp price index help you follow price changes. These tools show how supply and demand move each week. They also show how events like world tensions or economic changes affect the market. Watching these indices helps you spot trends and make smart choices.

Market Pulp Prices Trends

Demand and Supply Shifts

Market pulp prices have changed a lot this year. This happened because demand and supply moved up and down. When the U.S. and China raised tariffs, short-fiber pulp prices in China fell fast. This stopped prices from going up and made buyers more careful. These changes make the market less stable.

Here is a table that lists some main things that affect supply and demand:

| Factor | Description |

| Mill closures | Printing & Writing mill closures in North America and Europe reduced the supply of bleached kraft pulp. |

| Competitive market dynamics | Producers sell to the highest bidders, causing shortages in some regions and higher prices. |

| New pulp capacity | New capacity is coming, but not soon enough to ease current price pressures. |

Shipping delays in the Suez Canal and strikes in Finland have slowed pulp deliveries. These problems make it cost more and take longer to get pulp, especially in China. When mills in North and South America have maintenance delays, supply chain problems get worse. China needs more tissue and packaging, so pulp use stays high. This keeps market pulp prices from dropping. Experts think prices will keep changing as supply and demand stay tight.

Trade and Industry Developments

Trade and industry changes also affect market pulp prices. Since 2008, Asia Pacific and Latin America have doubled their share of the global pulp and paper trade. This change affects Western producers. Tariffs and supply chain problems make prices go up and down more. For example, when China put tariffs on US linerboard, the US import share dropped by half in ten months.

Many US buyers now buy from Mexican mills to avoid tariffs on Canadian and Chinese suppliers. This has led to more production and new business deals. Indian companies are also selling more to fill gaps left by Chinese suppliers. They offer better prices and lower risks for special papers.

There is also a push for low-carbon and renewable packaging. Laws like California’s EPR law make companies use cleaner materials. European and North American mills often have a lower carbon footprint, which helps them. Companies now work on new ideas and being open to earn your trust.

The US paper and paperboard market has fewer big companies now. But this did not make prices jump a lot. Demand and competition still help keep market pulp prices steady.

Paper Pulp Price Index & Influencing Factors

The paper pulp price index helps you see market changes over time. You can check the index each month to watch prices move. In July 2025, the price index hit a record high at 361.40600. In August, it dropped to 355.33200. These numbers show the market can change fast.

| Date | Price Index | Description |

| July 2025 | 361.40600 | Record high price index |

| August 2025 | 355.33200 | Recent price index reflecting market trends |

The recovered paper pulp price index tracks recycled paper pulp costs. This pulp comes from recycled materials. The amount imported grew from 2.44 million tons in 2021 to 4.47 million tons in 2023. The average price was $333 per ton in January 2021. It went up to $480 per ton in October 2021. By August 2023, it dropped to $253 per ton. These changes depend on recycling rates and trade rules. Watching the recovered paper pulp price index helps you spot trends and act quickly.

Raw Material and Energy Costs

Raw materials like wood and recycled fiber are important for pulp costs. In the EU, wood prices are rising. Producers worry about getting enough wood at a fair price. Some companies slow down investments because of this. Trade tensions also affect recycled fiber supply. When tariffs go up, supply chains get weaker and prices can drop. The paper and packaging sector faces many ups and downs from these changes. Recovered paper pulp is needed for new products, so its price matters for the whole market.

Energy costs are also a big part of making pulp and paper. Pulping and drying use lots of energy. Purchased energy is the third biggest cost for the industry. Companies try to save energy, but higher energy prices still raise paper pulp costs.

| Evidence Type | Description |

| Energy Cost Rank | Purchased energy is the 3rd largest operating cost for the industry. |

| Energy Efficiency | The industry works to increase energy efficiency. |

| Energy-Intensive Processes | Pulp production involves energy-intensive steps like pulping and drying. |

Environmental and Regulatory Impacts

There are more rules for pulp production now. These rules help cut air and water pollution and fight climate change. Over time, stricter standards have lowered emissions without big costs. New bleaching methods help meet these rules. Carbon pricing has helped a little, but not as much as some hoped.

Sustainability is more important every year. Many companies set Science-Based Targets to lower greenhouse gases. More companies use renewable resources now. This helps them follow rules and find new ways to earn money.

Logistics and Geopolitics

Logistics and world events can change the paper pulp price index fast. Shipping costs have gone up a lot. Rates from Shanghai to New York rose from $3,000 to $7,800. Delays and higher freight costs make it harder to get raw materials and deliver products. Port congestion and bad weather make things worse.

World events also matter. The Russian invasion changed the supply of paper and board in Europe and Ukraine. Sanctions on Russia made energy prices go up, which hurt pulp production. In India, shortages of chemicals and fiber made hardwood pulp prices jump by $85 in March. Coal prices also doubled, making production cost more.

When you watch the paper pulp price index and recovered paper pulp price index, you see how these things shape the market. Watching these trends helps you make better choices in a changing world.

2025 Forecast and Stakeholder Impact

Price Outlook

Paper pulp prices in 2025 might not go up much. Experts think big inventories could make producers lower prices. This could happen if demand stays weak. In 2019 and 2023, large stocks made prices drop fast. New tariffs on imports from Canada or Mexico could change prices again. Tariffs can make the market unstable. Prices might shift quickly if new rules appear.

Market pulp prices will likely stay the same or change a little. Producers have lots of stock, so they may cut prices to sell more. If demand grows, prices could go up. Most signs show the market will stay steady. Watch for new trade rules or changes in demand. These can make prices move fast.

Risks and Opportunities

There are several risks for market pulp prices in 2025. The table below lists the main risks that could change the forecast:

| Risk Type | Description |

| Supply Chain Disruptions | Strikes in Finland have slowed pulp supply chains and made it harder to get needed materials. |

| Potential Tariffs | New tariffs, like those from the Trump administration, could raise costs and make trade less stable. |

| Fluctuations in Demand | Lower consumer confidence in China has caused a 7% drop in market pulp imports. |

You also have many chances if you act early. The market is growing because people want greener products and better ways to make them. You can:

Invest in new recycling technology to make recovered paper pulp better and waste less.

Make biodegradable packaging to meet the need for green products.

Sell products in new places that fit local needs.

The global pulp market is getting bigger. It grew from USD 265.12 billion in 2024 to USD 275.06 billion in 2025. Experts think it will reach USD 357.72 billion by 2032. The yearly growth rate is 3.81%. This growth comes from more people wanting green packaging and more dissolving pulp used in clothes. If you follow these trends, you can find new ways to grow your business.

Implications for Industry

You need to get ready for a market where production and prices may not change much. Manufacturers will face high costs and tough competition from producers with lower costs. If you buy pulp, you may see prices and supply go up and down, especially in packaging, which uses a lot of pulp. Investors will watch the economy closely. This can change demand and their choices in the pulp and paper market.

To do well, you should:

Be flexible and change quickly when prices move.

Use new ideas and invest in new technology.

Focus on sustainability, since more customers and rules want greener products.

Make different products, especially packaging and special items.

Invest in better ways to process recovered paper pulp.

Companies that follow new trade rules and care about sustainability will lead the market. Technology and green practices will help you stand out. If you watch market pulp prices and the recovered paper pulp price, you can make smart choices and stay ahead.

Paper pulp prices go up and down for many reasons. These reasons include supply and demand, rules, and world events. You should pay attention to these important things:

If you want to do well, try these ideas:

Always watch for changes in the market. Using recovered paper pulp and making smart choices will help your business stay strong.

FAQ

What causes paper pulp prices to change?

You see prices change because of supply, demand, energy costs, and new rules. Weather, strikes, and world events also play a part. When you watch these factors, you can better predict price moves.

How do tariffs affect the pulp market?

Tariffs make it harder for some countries to sell or buy pulp. You may see prices go up or down fast. Tariffs can also change where companies buy their pulp.

Why do energy costs matter for pulp prices?

Pulp mills use a lot of energy. When energy prices rise, you pay more for pulp. If energy costs drop, you may see lower pulp prices.

Can recycled paper pulp lower costs?

Yes! Using recycled pulp often costs less than using new wood. You help the environment and save money when you use more recycled pulp.

What should you watch for in 2025?

Keep an eye on new trade rules, supply chain issues, and green packaging trends. These can change prices quickly. If you stay informed, you can make better choices for your business.